You Don’t Have to be an Accountant to Forecast Your Cash Flow

You don’t have to be an Accountant

But you do need to know your numbers!

It can be exciting to start your own small business. Independence, the freedom to set your own hours, to be your own boss, to finally get away from office politics. To have people pay for your goods or services, validating that what you’re doing is right. It’s all pretty heady stuff. Then reality starts to set in. Expenses seem to multiply overnight, expenses you hadn’t even considered. Expenses that need to be paid regardless of whether you’ve been paid yet or not. Clients who seemed so nice at the start, who are now delaying paying you. Before you know it, cash flow is threatening your ability to stay in business. Your head starts to spin from accounting jargon like accruals, debits, credits, capital outlays, P&L statements, balance sheets, the list seems to go on and on. You never expected to need to be a CPA just to run your small business. The good news is that you don’t have to be. That is what Accountants are for. However, you need to know your numbers. You need to know them well before you talk to your Accountant. This doesn’t mean that you have to know all the accounting intricacies, but you absolutely must know where you stand from a cash perspective. Yesterday, today, and what you anticipate for tomorrow.

Cash flow forecasting sounds technical, but it doesn’t have to be. Your numbers from yesterday and today are the inputs you combine with your knowledge of your business to forecast what’s likely to happen tomorrow.

At its core, a forecast only needs four things:

How much cash you have now

Expected cash coming in

Expected cash going out

When those movements will happen

You don’t need sophisticated accounting software. Most small businesses can forecast effectively using a structured workbook and realistic assumptions.

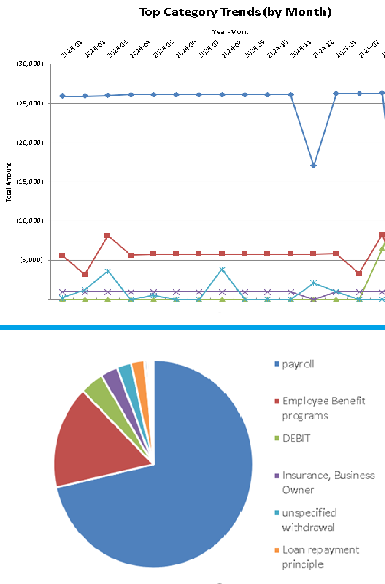

If you’ve been in business for even a short period of time, using past bank and credit card transaction records is a great source of data to assist in estimating expectations for both cash coming in and going out. If you don’t have such records, you’ll just have to rely more heavily on your own best judgement – just avoid being overly optimistic, wishful thinking derails more endeavors than most people are willing to admit.

The goal isn’t perfection — it’s visibility. To be forewarned is to be forearmed.

All of this can be done with spreadsheet workbooks, no sophisticated accounting software required. However, if building your own workbook sems too daunting, or just not a worthwhile use of your precious time, the inexpensive UltiCashFlow workbook at er2app.com was built by a small business owner for small businesses.