3 Ps of Cash Flow Management

Predict, Plan, Prosper

The three Ps of cash flow management are:

· Predict

· Plan

· Prosper

Predict

The first step in cash flow management is to predict what your cash in flows and out flows will be. What money will actually be coming in – not what is promised but what is actually being received. Keep in mind that not all clients will pay on time or in full, and that there may be transaction fees from credit card companies and banks that take a slice along the way. Let’s face it, as someone who chose to take the risk of starting a small business, you must have certain streak of optimism. It is wise to temper that optimism during the prediction stage. Consider the realistic probability of contracts being signed, expansion plans working, outreach and sales being as fruitful as hoped.

When considering the money going out, remember to factor in infrequent/irregular expenses as well. These may include items such as taxes and equipment repairs (beyond regular scheduled maintenance). It is wise to also consider inflation and timing of potential increases in cost of supplies, wages, and benefits. As you can see, even the planning stage is starting to overlap with the planning stage in terms of thinking about future obligations and opportunities.

If you’ve been in business for awhile, a great resource is actual transaction records from your bank and credit card accounts. With a good appreciation of anticipated monies coming in and going out, you can now leverage that to forecast what your cash flow needs will be. Depending on your business, you may need to look at this on a weekly, but at minimum on a monthly basis. You should look at this not just for the near term, but for a full 12 months. Consider which obligations are mandatory versus discretionary. Which ones are fixed versus variable. Which ones are the major expenses.

With these insights you can now transition more fully to the Plan stage.

Plan

Now that you have a forecast in hand, you can see when cash in the bank may be uncomfortably low. This is a good time to start exploring various scenarios. Can you consider alternatives that will reduce one or more of your top expenses? For example, if utilities are a major cost, does your electricity provider offer the option of choosing a less expensive generator; or if heating oil is a concern, can you switch to another supplier (often there are substantial discounts for new clients). Would a more aggressive marketing and sales campaign drive increased business? Perhaps including interest penalties for overdue payments will improve timeliness of payments from clients. Should you start requiring a greater percentage of the total cost as a down payment, or introduce quarterly payments rather than wait till the end. Obviously, the items you can change will vary greatly by the type of business you have. The trick here is be open minded and creative to explore what levers are available to reduce cost, increase revenue, or obtain additional funding.

Having visibility from forecasting your cash flow can greatly reduce the risk of late surprises. Which in turn puts you in a much better position when considering if and when to consider additional funding sources. As a small business owner, I must receive unsolicited text, email, and postal mail offers of immediate business financing several times a week. These merchant cash advance options are typically extremely costly, can have hidden consequences which can ultimately ruin your business. You need to be forewarned so you can plan ahead and make the best decision for you and your business, rather than feeling pressured into taking a poor choice. The forewarning comes from the Predict stage through the generation of your cash flow forecast.

Prosper

82% of business failures are attributed to cash flow problems. This is why it is so important to forecast your cash flow then plan how you can best manage your cash. Doing so will enable you to beat the odds to not only survive but thrive.

Common Cash Flow Mistakes Small Businesses Make

82% of business failures are due to cash flow problems

In this blog we outline the most common mistakes small businesses make when looking at their cash flow.

Most cash flow problems aren’t caused by a single big mistake — they’re caused by small, common ones.

The most frequent issues include:

Assuming invoiced sales equal cash

Overestimating how fast customers pay

Underestimating cancellations and bad debt

Not factoring in processing fees of credit cards

Ignoring tax until it’s due

Forgetting irregular expenses

Not allowing for surprise expenses

Not looking ahead more than a 1 quarter

Not planning to have enough reserves

Not factoring in interest on credit card debt

Not factoring in cost increases: labor, rent, insurance, supplies, …

Each of these issues can be spotted early with a simple forecast. Seeing problems months in advance gives you options — adjusting spending, chasing invoices, or arranging finance early.

A forecasting workbook helps turn these blind spots into visible, manageable decisions.

To Be Forewarned Is To Be Forearmed.

Profit Doesn’t Equal Cash in the Bank

Profit tells you whether your business is viable.

Cash flow tells you whether it can survive.

Profit is calculated using accounting rules — income earned and expenses incurred.

Cash flow, on the other hand, tracks actual money moving in and out of your bank account.

Common reasons profit and cash flow differ include:

Customer payment delays

Depreciation

Amortization

Loan repayments (which don’t appear on the profit report)

Tax paid after the profit is earned

Add in surprise expenses, whether it be from unanticipated repairs, new tariffs, having to bring in a contractor to fill in for an ill employee, the list goes on and on. This is why many successful businesses still experience stress around cash flow. At minimum, a cash flow forecast bridges the gap by translating profit into real-world timing. A better forecast allows you to explore various alternative scenarios.

A simple forecasting workbook helps you focus on what matters most: your future bank balance, not just past results. Gaining this visibility allows you to plan. Think of exploring scenarios and planning how to react as an athlete’s training. The actual event that occurs may not be what you planned for, but the mindset around options to consider develops the resilience to adapt and address whatever challenges do come your way.

Remember the adage: To Be Forewarned Is To Be Forearmed.

You Don’t Have to be an Accountant to Forecast Your Cash Flow

You don’t have to be an Accountant

But you do need to know your numbers!

It can be exciting to start your own small business. Independence, the freedom to set your own hours, to be your own boss, to finally get away from office politics. To have people pay for your goods or services, validating that what you’re doing is right. It’s all pretty heady stuff. Then reality starts to set in. Expenses seem to multiply overnight, expenses you hadn’t even considered. Expenses that need to be paid regardless of whether you’ve been paid yet or not. Clients who seemed so nice at the start, who are now delaying paying you. Before you know it, cash flow is threatening your ability to stay in business. Your head starts to spin from accounting jargon like accruals, debits, credits, capital outlays, P&L statements, balance sheets, the list seems to go on and on. You never expected to need to be a CPA just to run your small business. The good news is that you don’t have to be. That is what Accountants are for. However, you need to know your numbers. You need to know them well before you talk to your Accountant. This doesn’t mean that you have to know all the accounting intricacies, but you absolutely must know where you stand from a cash perspective. Yesterday, today, and what you anticipate for tomorrow.

Cash flow forecasting sounds technical, but it doesn’t have to be. Your numbers from yesterday and today are the inputs you combine with your knowledge of your business to forecast what’s likely to happen tomorrow.

At its core, a forecast only needs four things:

How much cash you have now

Expected cash coming in

Expected cash going out

When those movements will happen

You don’t need sophisticated accounting software. Most small businesses can forecast effectively using a structured workbook and realistic assumptions.

If you’ve been in business for even a short period of time, using past bank and credit card transaction records is a great source of data to assist in estimating expectations for both cash coming in and going out. If you don’t have such records, you’ll just have to rely more heavily on your own best judgement – just avoid being overly optimistic, wishful thinking derails more endeavors than most people are willing to admit.

The goal isn’t perfection — it’s visibility. To be forewarned is to be forearmed.

All of this can be done with spreadsheet workbooks, no sophisticated accounting software required. However, if building your own workbook sems too daunting, or just not a worthwhile use of your precious time, the inexpensive UltiCashFlow workbook at er2app.com was built by a small business owner for small businesses.

Profitable Small Businesses May Still Run Out of Cash

The number one reason for business failures is cash flow problems.

Your business can be profitable, and still be unable to meet obligations due to cash flow problems.

Many small business owners are surprised when they learn: profits don’t guarantee cash in the bank. You can be profitable on paper and still struggle to pay bills.

The reason is timing. Small businesses are often stuck between a rock and hard place. Tou have expenses that must be paid with little to no room to delay payments without serious consequences. Yet on the income side, there can be delays causing cash to arrive weeks or months late. I once had a global corporate client that would not only pay after work was completed, but they added a 4 week acceptance period to decide if they accepted the finished product or not. On top of that, they would only accept paper snail mailed invoices sent to their corporate headquarters in another country. But headquarters only logged receipt of the invoice and then sent it to another office in yet another country for processing. They then used the receipt date in the processing center as the start of the time clock for them to pay. Clearly a deliberate delaying practice that resulted in a contracted net 30 terms extending out to anywhere from 90 to 120 days before payment was received. I know of another global corporation that had intricate guidelines for submitting invoices. A friend who had them as a client often complained that it would take numerous revisions of every invoice before this client would accept it. The process was so complex that modelling a subsequent invoice after a prior approved one provided no guarantee of acceptance. The result was up to 6 months to receive payment! Less severe but still very annoying, I had yet another global corporate client that outsourced the payment processing to a third party. While this was touted as efficiency and cost savings for the client, the companies providing services and goods to the client had to pay this third party for their services. What these companies neglect in their short-sightedness is that these tactics add carrying costs that eventually need to be reflected in our pricing to them. Now these are extremes of dealing with large corporations that can throw their weight around. But any customer who receives your goods or services in advance of payment can pay late, have checks bounced, or become uncollectable debt. This doesn’t even begin to discuss income streams that are affected by seasonality or other exterior events outside of your control; weather is a prime example that affects timing of sales for many small businesses.

In the meantime, you have immediate expenses that must be paid. From employee salaries, suppliers, taxes, insurance, utilities, loan payments, plus all the other ordinary and unforeseen expenses for running your business. You need to have a really good handle on what expenses will come due when, in association with what cash will be received when.

For example, a business may show a healthy profit for the quarter, but if customers are slow to pay and a large tax bill is due, the bank balance can quickly turn negative.

This is why cash flow forecasting matters. A simple forecast shows when money is actually coming in and going out, giving you time to act before problems arise.

If you want a straightforward way to see this in advance, the cash flow workbook available at er2app.com is designed specifically for small businesses.

Commingled accounts now supported in UltiCashFlow

Dec 2025 Release of UltiCashFlow

The Dec 2025 release of UltiCashFlow has added the ability to import commingled bank and/or credit card transactions. This is of particular interest for early startups and solopreneurs who may have accounts that are used for both personal and business transactions - or in the event of an inadvertent mistake in using the wrong account. Upon import, you can indicate if the transaction file includes any personal transactions. If not, the system doesn’t bother you anymore and simply assigns a business allocation of 100%. However, if there are personal transactions included, you now have the opportunity to assign a business allocation percent (anywhere from 0% to 100%). Similar to other features, the workbook remembers prior assignments and automatically assigns them on the next import. The unfortunate reality, is that for some specific transactions the business allocation percent may vary over time. If so, the workbook recognizes when different percent allocations have been made and leaves it open for you to make the appropriate allocation after the import.

Back story

It all begins with an idea. In my case the idea of starting a business percolated in my mind for years (decades actually) before I finally did it. Over those years I toyed with ideas for various business concepts. What finally made me take the leap, was the fat that the company I worked for at the time was moving location to another state, and we did not want to relocate our high school age children. I seriously considered starting my own restaurant franchise. So I did my homework. I took classes on food based businesses at the New School in New York, I frequented restaurants of a similar model and took notes on customer traffic, staff, supplies, basically anything i could observe as a patron. Then I created an Excel workbook and crunched the numbers. My conclusion was it is very difficult to be successful with a restaurant. So I considered asking the CEO of a company I knew about possibly joining them. I had signed my employer up as their first large customer and had seen them grow. My concern was that the most exciting work (in my humble opinion) had largely been done; so figured I’d probably wind up in a role requiring a lot of travel. In my mind, if I’d have to do that much travelling again, then I might as well do it for myself. I decided to start my own consulting firm. As a side note, it is hard to find a name for a consulting firm in my niche that wasn’t already taken. I’ve had to explain to people my whole life, that yes my last name ends with 2 “er”s. Well Double ER sounds too much like a dude ranch, so I named my firm ER Squared. Figured I’d learn more in 6 months of starting and running my own company than I would in 5 years in another corporate environment - so I took the plunge. Well that 6 months turned into 11 successful years, before I accepted a position as a VP at one of my clients. Throughout this time I had numerous ideas about additional business opportunities, but did not have the time and resources to pursue them. Now that I retired from my last job, I have the time to pick some of these ideas up and run with them. Therefore, ER Squared is no longer a consulting firm, but still exists to pursue my other ideas. The first 2 are UltiVideoRec and UltiCashFlow. As this post is already getting a bit long, I’ll share the back stories for each of these in additional posts.

It all begins with an idea, coupled with conditions to make the plunge.

It all begins with an idea. In my case the idea of starting a business percolated in my mind for years (decades actually) before I finally did it. Over those years I toyed with ideas for various business concepts. What finally made me take the leap, was the fact that the company I worked for at the time was moving location to another state, and we did not want to relocate our high school age children. I seriously considered starting my own restaurant franchise. So I did my homework. I took classes on food based businesses at the New School in New York, I frequented restaurants of a similar model and took copious notes on customer traffic, staff, supplies, basically anything i could observe as a patron. Then I created an Excel workbook, researched costs, and crunched the numbers. I concluded it is very difficult to be successful with a restaurant. One option I considered was asking a CEO I knew about possibly joining their company that I had a very favorable opinion of. I had signed my employer up as their first large customer and had seen them grow. My concern was that the most exciting work (in my humble opinion) had largely been done; so figured I’d probably wind up in a role requiring a lot of travel. In my mind, if I’d have to do that much travelling again, then I might as well do it for myself. I decided to start my own consulting firm. As a side note, it is hard to find a name for a consulting firm in my niche that wasn’t already taken. I’ve had to explain to people my whole life, that yes my last name ends with 2 “er”s. Well Double ER sounds too much like a dude ranch, so I named my firm ER Squared. Figured I’d learn more in 6 months of starting and running my own company than I would in 5 years in another corporate environment - so I took the plunge. Well that 6 months turned into 11 successful years, before I accepted a position as a VP at one of my clients. Throughout this time I had numerous ideas about additional business opportunities, but did not have the time and resources to pursue them. Now that I retired from my last job, I have the time to pick some of these ideas up and run with them. Therefore, ER Squared is no longer a consulting firm, but still exists to pursue my other ideas. The first 2 are UltiVideoRec and UltiCashFlow. I’ll share the back stories for each of these in additional posts.

Back Story: UltiVideoRec

It all begins with an idea.

One the things I learned is that there are more opportunities than I’ll ever have the time and resources to pursue. For example, I have ideas about numerous websites that I think have potential. So my plan was to tie them all together under a common umbrella, and hence have assigned the prefix “Ulti” to all of them. The first of these that I did pursue was UltiCareer. The concept for UltiCareer was to have a site where people from all walks of life describe what a day in the life of their job is like, and what they like and dislike about it. The plan was that this would be a fantastic resource for students or anyone considering a career change to explore the vast array of potential jobs and get first hand insights into what it is like to actually do that job. Seemed like everyone I talked to loved the idea as a resource, especially for students, and stated they wished such a tool was available to them when they were starting out. The challenge was that while everyone agreed it was a great concept, very few people were willing to take the time to respond to even a simple questionnaire to share their insights. Struggling to find a way around this, I found that many people liked the idea of being interviewed, so all they had to do was talk in response to questions posed by the interviewer - they also liked the stroke to their egos of being interviewed and recorded. Problem is, that approach just isn’t scalable. So I explored creating a tool in which questions could be posed and respondents could record their responses themselves on a laptop , tablet, or smart phone. As we started developing this tool, quickly realized that it has numerous potential uses both for businesses and personal use. Which became the pivot to start developing UltiVideoRec, the multiplatform tool for creating a form of questions and collecting video recorded responses.

Business uses include (but are not limited to) collecting customer testimonials, feedback on product or services, collecting user persona insights for distribution to the entire product development team, collecting and sharing congratulatory or best wishes from colleagues for an employee who is retiring or achieved a major event or significant anniversary.

Personal uses include (again not limited to) collecting and sharing birthday wishes from geographically distributed family and friends; congratulatory message for a major anniversary, graduation, wedding, engagement, or any other event; sharing messages of thanks from children’s sports team to their coach; collecting content to share on a blog/vlog; etc.

Basically, uses are only limited by our imagination.

Back Story: UltiCashFlow

It all begins with an idea.

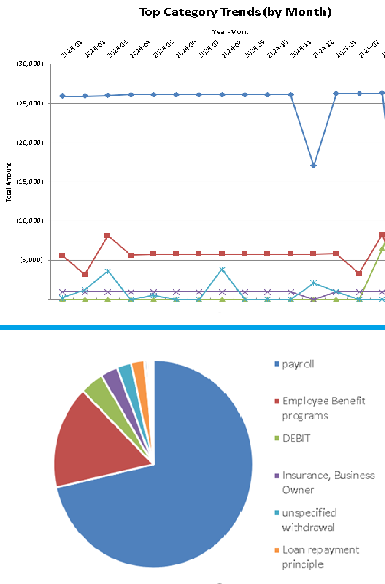

Being a small business owner involved a lot of learning and some experimentation. In my particular situation, my biggest expense was employees which is complicated by today’s environment of distributed remote workers who reside and work in different states with different payroll tax rules. Further complicating matters is that my business involved a lot of proposals and nurturing prospects, which required attributing percentages of success to forecast future revenue. To manage these major complications and the myriad of other expense details, I created an extensive Excel workbook to track revenue and expenses, and better yet to forecast future cash flow. Talking to my accountant, banker, and fellow small business startups it was apparent that many small business owners could greatly benefit from having a similar tool. So went about converting my Excel workbook into a configurable workbook that goes to great lengths to hide complexity and simply the process so anyone can use it without needing any Excel skills.

Why Excel you may ask? Frankly, I already had the beginnings of it from the tool I had developed for my own business; but more importantly I wanted to use a tool that most small businesses would already have and be at least somewhat comfortable using. Additionally, this allows for the workbook to be installed on each owner’s own computer, thus avoiding any security concerns about their data being on the web and potentially exposed to prying eyes. I also wanted to keep the development cost to a minimum so I can offer it at a very attractive cost for small businesses, especially those just getting started.

Within er2app.com, you can go to the menu item “Store” to purchase a license, download the workbook and get started.